Hello there!

This week in the 0100 Weekly Brief, we’re diving into one of the biggest changes happening in private markets today: the impact of artificial intelligence in private equity.

What once sounded visionary is now becoming a tangible driver of deal flow, decision-making, and portfolio performance. According to the latest market reports, AI is a tool investors are actively using to make smarter decisions and unlock new sources of value.

The numbers tell the story: The Silicon Valley Bank found that capital call activity among tech-focused funds has jumped 65%, showing that investors are pouring money into AI-related opportunities at a pace that far exceeds other sectors.

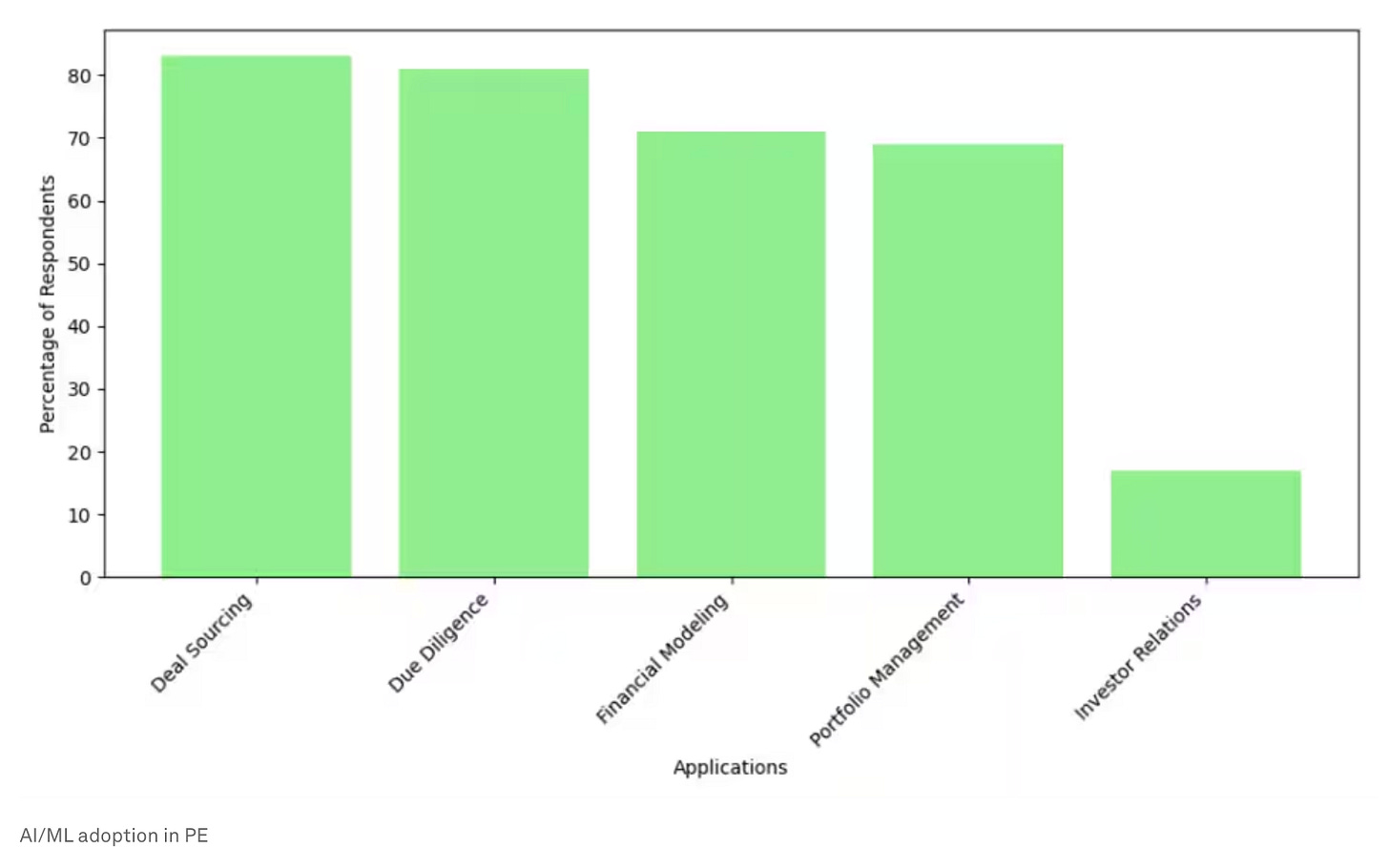

At the same time, nearly all private equity firms are now exploring AI tools, with the biggest players already integrating them into daily operations. Many are using AI to improve deal sourcing, automate due diligence, analyze portfolio data faster, and even predict performance before it happens. For fund managers, this means AI isn’t just an operational helper; it’s becoming a core part of how they create value.

But how much value is it really creating so far?

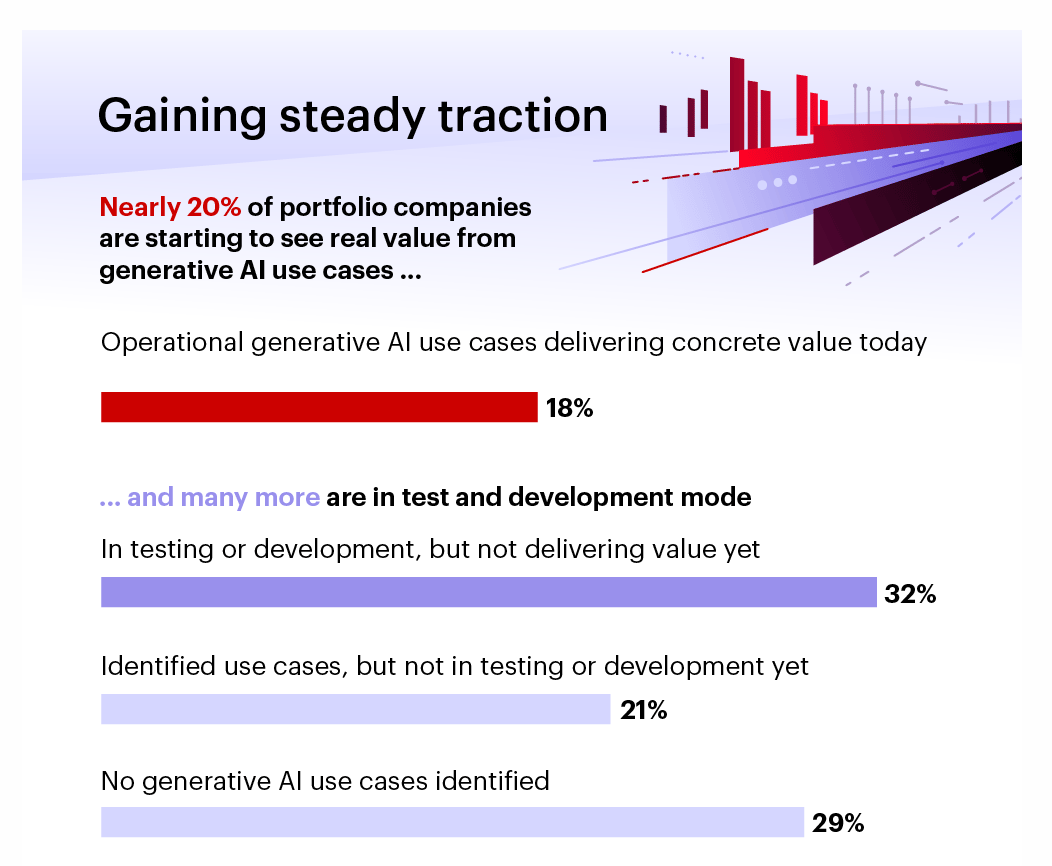

Bain & Company offers us some perspective. Almost 20% of portfolio companies are already seeing measurable business impact from generative AI — things like cost reductions, productivity gains, and faster product development.

Another 32% are actively testing or developing AI use cases, showing strong momentum toward adoption. Looking ahead, over half of investors (57%) expect significant value from AI within five years, making it one of the most promising growth areas in private markets.

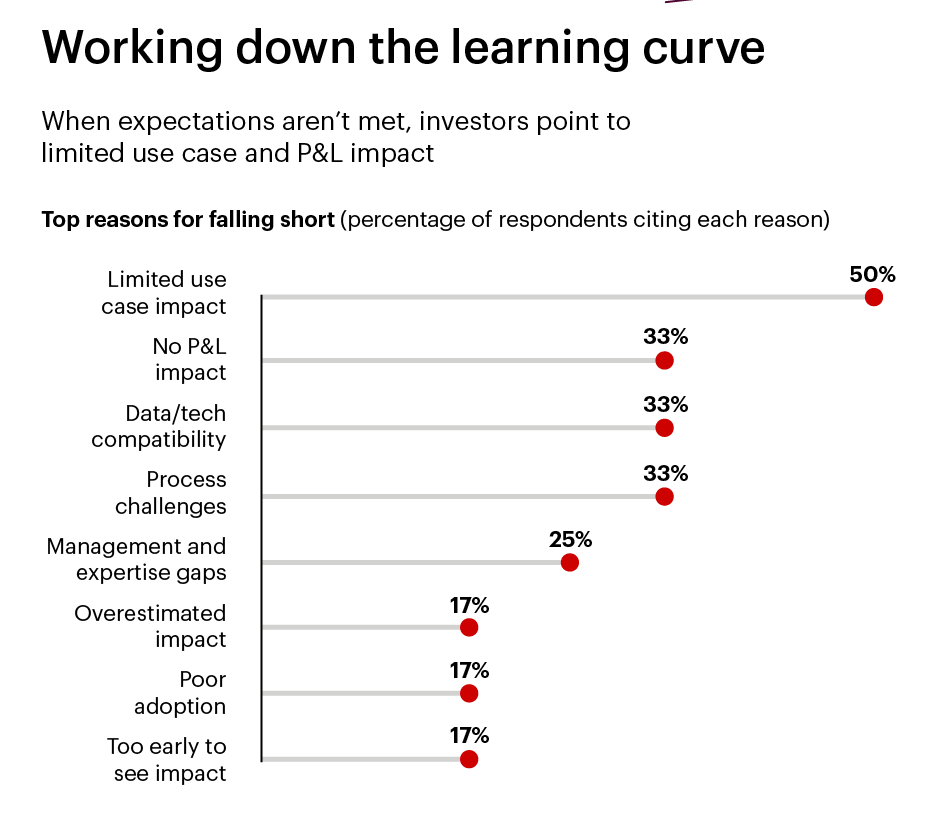

Of course, the road isn’t without bumps. Investors admit they’re still figuring out how to measure AI’s real impact. The top challenges? Limited use cases, lack of technical expertise, and unclear governance.

As a result, due diligence standards are getting tougher.

Investors are now digging deeper into how target companies use AI, not just what tools they have, but whether they have the right data infrastructure, leadership commitment, and risk controls in place. While most investors want companies with strong AI readiness, very few actually find those conditions during due diligence.

AI’s growing influence is also changing how PE firms operate day to day.

Across the industry, firms are using AI and machine learning to speed up due diligence, identify deals faster, and monitor portfolios in real time. According to the World Economic Forum, over 80% of private equity workflows already rely on these technologies, and nearly all firms plan to increase their AI investments within the next 18 months.

PE firms are also leaning on AI to navigate uncertainty and target opportunities more precisely. The technology is also reshaping exit strategies, with secondary and leveraged buyouts leading the way, followed by private sales and IPOs.

Deep Dive into AI at 0100 International

Coming soon at 0100 International in Milan, we have a conversation diving deeper into the influence of AI in the investment landscape. While everyone agrees AI offers incredible opportunities, the discussion also dives into the realities, how to find the right deals, balance risk with reward, and make smart calls in a space that’s moving faster than ever.

Joining the conversation are seasoned leaders from across the global investment landscape: Matt Russell of VenCap, Shu Nyatta of Bicycle Capital, Christoph Klink of Antler, Stephan Wirries of Ventech, Johannes Blaschke of Calm/Storm VC, and Philippe Thomas of Vaultinum.

📝 Expert Round-up | How CAPZA is turning Italy’s small and mid-market into a growth engine for European private capital

Just as AI is helping investors identify opportunities and manage portfolios more efficiently, CAPZA is using insight and flexibility to unlock value in overlooked parts of the market. Italy’s vibrant ecosystem of family-run SMEs, especially in digital, healthcare, and business services, is creating fertile ground for this kind of smart, hands-on investing.

With Milan emerging as a new European financial hub, and technology driving more of the deal-making process, CAPZA’s approach shows how innovation — whether digital or strategic — is powering the next chapter of European private equity growth.

🌍 Across the Ecosystem | News & Useful Resources for You

Everyone in private equity is talking about AI right now — and for good reason. From finding deals faster to improving due diligence and managing portfolios, AI is changing how investors work and make decisions. Governments and industry leaders are also looking at how technology can boost growth and make private markets more efficient and transparent.

Here’s a look at what’s happening across the industry:

🗞️ News | Mega AI deals enable exits for private equity

The boom in AI-driven companies is giving private equity firms new ways to exit investments, especially through IPOs and acquisitions, as stock markets rally around artificial intelligence. According to CNBC, the surge in AI deals has reopened exit channels that were mostly closed over the past year, offering much-needed liquidity for investors.

But alongside the excitement, many in the industry are warning of a growing “AI bubble.” Some investors say parts of the market are becoming overheated, with valuations rising faster than real profits. As a result, more cautious firms are focusing on AI businesses with proven revenue and strong fundamentals, rather than chasing hype.

🗞️ News | How Private Equity Firms Are Creating Value with AI

A new Harvard Business Review article explains how private equity firms are using AI to create value faster in their portfolio companies. Since PE firms usually aim to buy, improve, and sell a company within five to seven years, they’re turning to AI to speed things up.

More firms are also now hiring AI experts or teaming up with tech partners to make these tools part of their everyday process.

🎤 The Private Equity Podcast | How AI and Product Strategy Are Reshaping Value Creation

In this episode of The Private Equity Podcast, host Alex Rawlings sits down with David Rowley, Operating Partner at Diversis Capital, to talk about how AI and strong product strategies are changing value creation in private equity.

David also dives into how AI is reshaping product development and innovation. He also compares today’s AI revolution to the rise of agile methods in the early 2000s, both forcing companies to think faster and smarter.